Market Report 2025

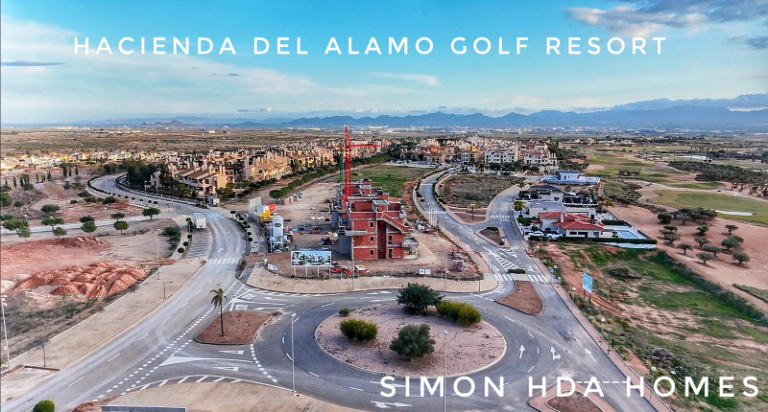

Hacienda del Álamo Property Market Report – 2025

The 2025 property market at Hacienda del Álamo marked a major turning point for the resort, driven by the complete clearance of bank‑owned stock, strong new‑build absorption, and renewed confidence from both buyers and investors. With new commercial openings, rising resale values, and a committed long‑term owner now in place, the resort experienced one of its most stable and dynamic years to date.

Key Market Highlights of 2025

• All SAREB stock sold At the start of 2025, all bank‑owned (SAREB) residential and commercial properties were fully sold. This immediately allowed the resale market — particularly in Spanish Village, El Oasis, and Los Olivos — to stabilise at true market value, free from distressed‑stock pressure.

• Hozono strengthened its position Hozono, already the owner of the development plots, became increasingly visible throughout 2025. Their strategic acquisition of the golf course, sports centre, clubhouse, and hotel provided long‑term operational stability and renewed confidence in the resort’s future.

• Strong new‑build absorption Of the 218 new‑build properties released in 2025, 101 were sold, representing more than €30 million in buyer commitment — almost two new‑build sales per week.

• Revival of the Spanish Village The commercial heart of the resort saw a clear resurgence with the arrival of new businesses, including: – A bakery – Rangla Punjab – Monica & Salva’s Hair Salon – Hervi’s Furniture Shop Window – Pueblo Spa

This renewed activity has strengthened community life and increased footfall across the resort.

• Over 150 resale completions More than 150 resale properties completed during the year, including a standout transaction exceeding €750,000, confirming strong demand at the upper end of the market.

• Privately owned plots selling strongly Toward the end of the year, privately owned plots sold exceptionally well, signalling a forthcoming wave of bespoke, owner‑designed homes.

Looking Ahead to 2026

2026 is shaping up to be a pivotal year for Hacienda del Álamo. With all bank stock cleared early in 2025, a committed long‑term owner in place, tightening resale availability, and sustained demand for new builds, the resort is positioned for continued upward momentum.

Market indicators for 2026 suggest:

• Further price consolidation at higher levels • Ongoing absorption of new‑build phases • Increased demand for larger, higher‑specification homes • Strong interest from lifestyle buyers and long‑term investors

2025 reset the market — 2026 is set to accelerate it.